ESG Activities

Corporate governance

Overview of corporate governance

Basic approach to corporate governance

The Company believes that the essence of corporate governance is to ensure transparency and fairness in decision-making, to make full effective use of its management resources, and to increase the vitality of its management through prompt and decisive decision-making, from the viewpoint of achieving sustainable growth of the Company and enhancing its corporate value over the medium to long term and the company is striving to improve corporate governance based on the following basic ideas

- Respect the rights of shareholders and ensure equality.

- Consider the interests of stakeholders, including shareholders, and work appropriately with them.

- Disclose company information appropriately and ensure transparency.

- Endeavor to ensure the effectiveness of the supervisory function of the execution of business by the Board of Directors.

- Engage in constructive dialogue with shareholders.

Outline of the corporate governance system and reasons for adopting the system

In accordance with the resolution of the 71st annual general meeting of shareholders held on January 28, 2021, the Company has shifted from a company with an Audit & Supervisory Board to a company with an Audit and Supervisory Committee, with a view to further strengthening its corporate governance.

The purpose of the transition to a company with an Audit and Supervisory Committee is to strengthen the supervisory function of the Board of Directors by appointing Audit and Supervisory Committee Members who are in charge of auditing the execution of duties by Directors as members of the Board of Directors, and to further enhance corporate governance through strengthening the monitoring system.

The Board of Directors of the Company consists of 15 members: 10 Directors Motohide Nishimura, Takao Tahara, Atsuhiro Yoshida, Kazuto Narita, Toyo Usho, Kiyoto Fukada, Motokazu Nishimura, Nobuko Shimaoka, Masanori Hanayama and Isamu Fukuda; and five outside Directors Tooru Muneoka and Tsuyoshi Kondo, and Audit and Supervisory Committee Members Hiromichi Yamajo, Shinichi Mori and Masaki Hirata. The Board of Directors meets once a month and holds extraordinary meetings as necessary to supervise decisions on matters stipulated by laws and regulations as well as important management matters and the status of business execution, chaired by Motohide Nishimura.

The Management Council, which consists of all of the executives Directors, meets once a month to deliberate and make decisions on important matters related to the execution of corporate business and to conduct preliminary examinations of the Board of Directors.

In addition, the Company has introduced an Executive Officer system in order to clearly separate the decision-making body for management from the supervision of business execution and executive body.

The Audit and Supervisory Committee of the Company consists of three members: outside Director Hiromichi Yamajo, who is a full-time Audit and Supervisory Committee Member, and outside Directors Shinichi Mori and Masaki Hirata, who are Audit and Supervisory Committee Members. All of them are outside Directors. The Audit and Supervisory Committee has a system to monitor the execution of legal and appropriate management in cooperation with the Internal Audit Division and the Financial Auditor.

The Company has established a Nominating Committee, which is a voluntary advisory body. The Committee consists of six members: Director Motohide Nishimura, outside Directors Tooru Muneoka and Tsuyoshi Kondo, outside Director Hiromichi Yamajo, who is a full-time Audit and Supervisory Committee Member, and outside Directors Shinichi Mori and Masaki Hirata, who are Audit and Supervisory Committee Members. The Committee is chaired by outside Director Tooru Muneoka. The Committee deliberates on the proposal for the election or dismissal of Directors to be submitted to the general meeting of shareholders, and the proposal for the selection, removal, and division of duties of the Representative Director and executive Directors, the proposal for candidates for Executive Officers, and matters related to formulation and supervision, etc. of the President’s succession plan to be submitted to the Board of Directors in response to the Board of Directors’ advisory, and provides recommendations to the Board of Directors. The Board of Directors makes decisions on matters to be deliberated on with the utmost respect for the recommendations of the Committee.

The Company has established a Remuneration Committee, which is a voluntary advisory body. The Committee consists of seven members: Directors Motohide Nishimura and Kazuto Narita, outside Directors Tooru Muneoka and Tsuyoshi Kondo, outside Director Hiromichi Yamajo, who is a full-time Audit and Supervisory Committee Member, and outside Directors Shinichi Mori and Masaki Hirata, who are Audit and Supervisory Committee Members. The Committee is chaired by outside Director Tooru Muneoka. The Committee deliberates on proposals for remuneration for Directors to be submitted to the general meeting of shareholders and matters related to the remuneration for Directors in response to the Board of Directors’ advisory and provides recommendations to the Board of Directors. The Board of Directors makes decisions on matters to be deliberated on with the utmost respect for the recommendations of the Committee.

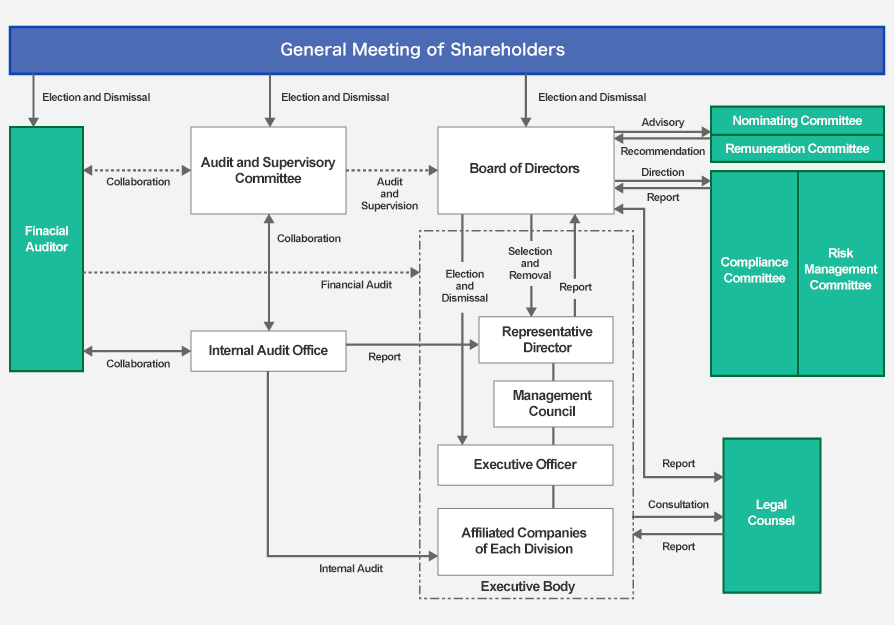

The Company’s corporate governance structure is as follows.

The Company’s corporate governance structure

Other matters related to corporate governance

Development of the internal control system

Systems to ensure that the duties of directors and employees of the Company and its subsidiaries comply with laws and regulations and the Articles of Incorporation

- The Company and its subsidiaries shall establish the Senshu Electric Group Code of Conduct to act in compliance with laws and regulations, the Articles of Incorporation, and social norms.

- The Company and its subsidiaries shall ensure thorough compliance in accordance with the Compliance Regulations and establish a compliance promotion system within the Compliance Committee.

- The Internal Audit Office audits the compliance status of the Company and its subsidiaries in cooperation with the Compliance Committee, and periodically reports the results to the Board of Directors and the Audit and Supervisory Committee.

- The Company shall establish and administer a hotline (whistle-blowing system) in accordance with the Corporate Ethics Helpline Regulations as a means for employees to provide information directly on activities that are legally questionable.

- The Company and its subsidiaries shall have no relationship with antisocial forces and organizations that pose a threat to social order and security, and shall take a resolute stance against antisocial forces and organizations.

System concerning the preservation and control of information related to the execution of duties by directors

Information pertaining to the execution of duties by Directors shall be recorded and stored in documents or electromagnetic media (hereinafter referred to as a document, etc.) in accordance with the Document Management Rules, and Directors shall be able to inspect these documents, etc. at all times in accordance with the Document Management Rules.

Rules and other systems concerning the management of risk of loss for the Company and its subsidiaries

- The Company and its subsidiaries shall clarify the risk management of the Company and its subsidiaries in accordance with the Risk Management Rules and the Crisis Management Rules, and establish a risk management promotion system within the Risk Management Committee.

- The Internal Audit Office shall audit the status of risk management of the Company and its subsidiaries and periodically report the results to the Board of Directors and the Audit and Supervisory Committee.

Systems to ensure that the duties of directors of the Company and its subsidiaries are executed efficiently

- The Company’s Board of Directors meets once a month and holds extraordinary meetings as necessary to supervise decisions on matters stipulated by laws and regulations as well as important management matters and the status of business execution.

- The Management Council, which consists of all of the executives Directors, meets once a month to deliberate and make decisions on important matters related to the execution of corporate business and to conduct preliminary examinations of the Board of Directors.

- The Company has introduced an Executive Officer system in order to clearly separate the decision-making body for management from the supervision of business execution and executive body.

- The Company and its subsidiaries shall formulate medium-term management plans that take into account the future business environment, create budgets for each business year, and formulate and implement specific plans to achieve these goals.

Systems to ensure the appropriateness of financial reporting

In accordance with the Financial Instruments and Exchange Act, in order to ensure the appropriateness of financial reporting, the Company and its subsidiaries shall establish a basic policy for internal control over financial reporting, and shall develop, operate, and maintain systems necessary for internal control in accordance with this policy.

Systems to ensure the appropriateness of business operations of the corporate group consisting of the Company and its subsidiaries

- In accordance with the Rules for Management of Affiliated Companies, the Company shall require its subsidiaries to report management information on a regular basis, and shall improve the management efficiency of the Company and its subsidiaries as a whole through support and guidance necessary for efficient management.

- Directors of the Company shall concurrently serve as Directors of its subsidiaries to establish internal control of the Company and its subsidiaries.

- The Company’s Audit and Supervisory Committee and Internal Audit Office shall conduct internal audits of the Company and its subsidiaries, and establish systems to ensure the appropriateness of business operations of the Company and its subsidiaries.

Matters concerning directors and employees who are to assist the duties of the Audit and Supervisory Committee, and matters concerning the independence of said directors and employees from other directors (excluding directors who are Audit and Supervisory Committee Members) and ensuring the effectiveness of instructions given to said directors and employees

- The Audit and Supervisory Committee shall request the Directors concerned to establish a system to ensure the independence of Directors and employees who are to assist the duties from Directors (excluding Directors who are Audit and Supervisory Committee Members) in accordance with the Rules for the Audit and Supervisory Committee and the Standards for Audits, etc. by the Audit and Supervisory Committee.

- The Directors and employees shall perform their duties under the direction and order of the Audit and Supervisory Committee.

- Personnel changes and personnel evaluations of such Directors and employees shall require the consent of the Audit and Supervisory Committee.

ystems for directors (excluding directors who are Audit and Supervisory Committee Members) and employees of the Company and directors and employees of its subsidiaries to report to the Audit and Supervisory Committee, and other systems related to reporting to the Audit and Supervisory Committee, and systems to ensure that they are not treated unfairly for making such reports

- Directors who are Audit and Supervisory Committee Members shall attend meetings of the Board of Directors, the Management Council, and other important meetings and receive important reports.

- Directors (excluding Directors who are Audit and Supervisory Committee Members) and employees of the Company and directors and employees of its subsidiaries shall promptly report to the Audit and Supervisory Committee matters that have a material impact on the business or performance of the Company and its subsidiaries, in addition to matters stipulated by laws and regulations.

- The Company shall prohibit any person who has made a report referred to in ii above from being treated unfairly for making such report.

Matters concerning the policy for the advance payment of expenses or processing of debts incurred in the execution of duties by Audit and Supervisory Committee Members

When an Audit and Supervisory Committee Member makes a request for advance payment or reimbursement of expenses incurred in the execution of his/her duties, the Company shall promptly process said expenses or debts unless it is deemed unnecessary for the execution of his/her duties.

Other systems to ensure that audits by the Audit and Supervisory Committee are conducted effectively

- The Audit and Supervisory Committee Members shall hold regular meetings with the Representative Director and establish a system to deepen mutual understanding with the Representative Director by, for example, exchanging information and reporting and reviewing the status of business execution.

- The Audit and Supervisory Committee shall establish a system to enhance the effectiveness and efficiency of audits by closely cooperating with the Internal Audit Office and the Financial Auditor through exchanging information and opinions.

Outline of the limited liability agreement

Pursuant to the provisions of Article 427, Paragraph 1 of the Companies Act, the Company and outside Directors have entered into an agreement to limit their liability for damages under Article 423, Paragraph 1 of the same Act. The maximum amount of liability for damages under the agreement shall be the amount stipulated by laws and regulations. The limitation of liability is permitted only when the outside Director has acted in good faith and without gross negligence in performing the duties that caused the liability.

Outline of the directors and officers liability insurance policy

The Company has taken out a directors and officers liability insurance policy with an insurance company as provided in Article 430-3, Paragraph 1 of the Companies Act, wherein the insured persons are Directors and Executive Officers of the Company and its subsidiaries. All insurance premiums are paid by the Company.

An outline of this insurance policy is that the insurance company shall indemnify the damage that may occur under the insurance policy when the insured officer is liable for the execution of his/her duties or when he/she receives a claim for pursuing such liability.

Damages, etc., arising from actions taken with the awareness that they are in violation of laws and regulations shall be treated as a disclaimer under the insurance policy, and the Company takes measures to ensure that the appropriateness of the execution of duties by the insured officers is not impaired.

Number of Directors

The Company’s Articles of Incorporation stipulate that the number of Directors (excluding Directors who are Audit and Supervisory Committee Members) shall be 12 or less and that the number of Directors who are Audit and Supervisory Committee Members shall be four or less.

Requirements for resolution on election of Directors

The Company’s Articles of Incorporation stipulate that resolutions for the election of Directors shall be passed by a majority of the voting rights of the shareholders present at the meeting who hold at least one-third of the voting rights of the shareholders entitled to exercise their voting rights, distinguishing between Directors who are Audit and Supervisory Committee Members and Directors who are not, and that such resolutions shall not be made by cumulative voting.

Matters to be resolved at the general meeting of shareholders that may be resolved by the Board of Directors

Acquisition of treasury shares

The Company’s Articles of Incorporation stipulate that the Company may acquire its own shares through market transactions, etc. by resolution of the Board of Directors in accordance with Article 165, Paragraph 2 of the Companies Act, in order to enable the Company to implement its capital policy flexibly in response to changes in the business environment.

Interim dividend

The Company’s Articles of Incorporation stipulate that, in accordance with Article 454, Paragraph 5 of the Companies Act, it may pay interim dividends on April 30 of each year as the record date pursuant to a resolution of the Board of Directors, in order to return profits to shareholders in an agile manner.

Special resolution requirements for the general meeting of shareholders

The Company’s Articles of Incorporation stipulate that special resolutions for the general meeting of shareholders as provided in Article 309, Paragraph 2 of the Companies Act shall be passed by at least two-thirds of the voting rights of the shareholders present at the meeting who hold at least one-third of the voting rights of the shareholders entitled to exercise voting rights. This is intended to ensure smooth management of general meetings of shareholders by relaxing the quorum for special resolutions at the general meeting of shareholders.